⏰ Payroll Pitfalls: The #1 Tax Delay for Australian Cafes With Hourly Staff

Hourly staff are the heart of Australian cafes—but payroll complexity is the biggest tax-time risk.

For the small-to-medium Australian cafe, the true heart of the business isn't the espresso machine—it's the hourly staff. Your casual and part-time team are the lifeblood of your service, but the complexity of their payroll is, without a doubt, the single biggest drag on your time and the leading cause of tax delays during reconciliation.

The most searched for term and the biggest compliance risk in Australian hospitality accounting isn't inflated income—it's wage compliance and penalty rate errors. The Fair Work Ombudsman (FWO) and the Australian Tax Office (ATO) demand perfection, and the intricate web of shift management, casual loading, superannuation, and tip records is where most cafes stumble, leading to costly delays and audit risk.

If you rely on spreadsheets or manual time-tracking, you are haemorrhaging time and paying your accountant a premium to untangle the mess.

Manual payroll systems turn reconciliation into a time-consuming nightmare.

This blog dives deep into the complexities that turn hourly staff payroll into a tax season bottleneck and outlines the simple, digital solution that puts your cafe on the fast track to BAS (Business Activity Statement) readiness.

The Australian Payroll Hydra: Why Hourly Staff Are a Reconciliation Nightmare

The average Australian café operates under the Restaurant Industry Award or the Hospitality Industry (General) Award, both of which contain a bewildering array of conditions based on when the employee works.

When you manage hourly staff manually, you are facing a multi-headed monster of complexity in every pay run, all of which must be 100% accurate for tax reporting:

1. The Penalty Rate Minefield

Penalty rates change by day, time, and shift—leaving no room for error.

For hourly staff, the rate of pay changes depending on the day and time of the shift. Missing a single penalty rate can trigger an underpayment claim, but getting the calculation right manually is incredibly time-consuming.

* Weekends: Saturday rates are generally higher than weekday rates, and Sunday rates are often significantly higher than Saturday rates.

* Public Holidays: These attract the highest penalty rates (often 225% or more). Missing the correct calculation on a single Public Holiday shift means your payroll tax (PAYG Withholding) and Superannuation Guarantee (SG) are incorrectly calculated for that employee, creating errors that must be corrected during year-end reconciliation.

* Overtime: Calculating overtime correctly—which often triggers after a specific number of hours in a day or week—is almost impossible without automated time tracking.

2. Casual Loading and Classification

Casual employees receive a higher hourly rate (Casual Loading, typically 25%) in lieu of paid leave entitlements. Correctly applying this loading, while ensuring they are also paid the correct penalty rates on top of the loading, requires precision. Misclassifying an employee as casual when they should be part-time can expose the business to significant back-pay and fines.

Employee misclassification is one of the fastest ways to trigger back-pay claims.

3. Superannuation Guarantee (SG) Complexity

Superannuation is calculated on an employee's Ordinary Time Earnings (OTE), which generally includes the casual loading and penalty rates for ordinary hours, but usually excludes bona fide overtime. The calculation rate changes annually (currently scheduled to reach 12% by July 2025). The reconciliation pitfall here is common: The cafe owner fails to pay SG on all OTE components, or pays it late, triggering the non-deductible Superannuation Guarantee Charge (SGC) and the need for significant tax adjustments.

Incorrect super calculations can lead to non-deductible Superannuation Guarantee Charges.

4. The Black Hole of Cash and EFTPOS Tips

Poor tip tracking creates PAYG and super compliance headaches.

While tips are not generally subject to GST, they can be considered income for PAYG Withholding and Superannuation purposes, depending on how they are collected and distributed. Manual systems often fail to properly track tips paid via EFTPOS (which often land in the business bank account) versus cash tips (which may be immediately distributed). The lack of a clear, verifiable record on how tips were processed creates a compliance headache for your accountant.

The Hidden Cost of Manual Payroll to Tax Season

When you manage payroll using spreadsheets, paper timesheets, or basic, disconnected systems, every single reconciliation step is manual:

Manual payroll doubles reconciliation time during tax season.

* Timesheet-to-Pay Calculation: Manually checking a shift against the Award to determine the correct penalty rate, calculating the total OTE, and subtracting PAYG.

* PAYG Reconciliation: Your accountant must cross-reference your total Wages Paid in your accounting software with your PAYG Withheld remitted to the ATO. Errors in the initial PAYG calculation (due to misapplied rates) lead to massive time sinks during year-end.

* Superannuation Audit: Manually verifying that the SG paid aligns precisely with the OTE calculated for every employee, every quarter.

The collective time spent by your bookkeeper or accountant on these tasks can easily double your administrative costs leading up to tax deadlines.

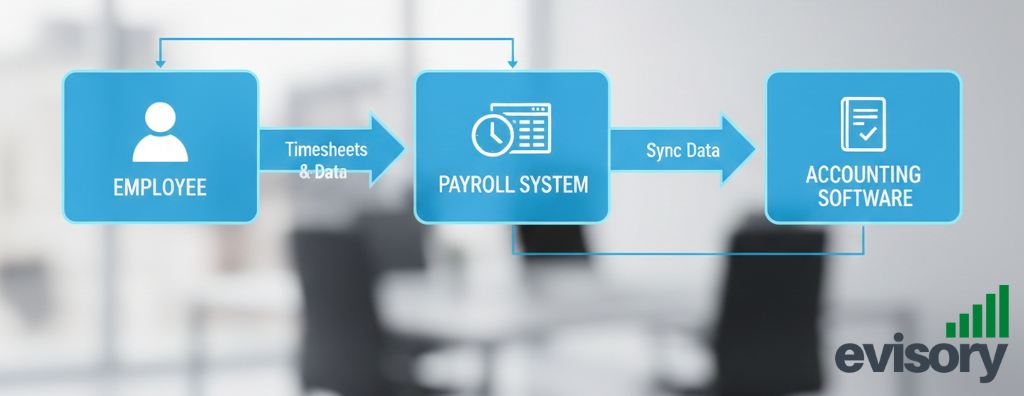

The Digital Solution: Payroll Systems that Talk to Your Accountant

Integrated payroll systems eliminate double-entry and compliance errors.

The fastest and most effective way for a cafe with hourly staff to become BAS-READY is to implement an integrated payroll system. These systems, built specifically for the Australian market, automatically interpret complex Awards and sync perfectly with your accounting platform.

The core benefit is zero double-entry and built-in compliance.

Top Integrated Payroll Systems for Australian Hospitality:

| System | Best For | Key Feature for Compliance | Accounting Integration |

|---|---|---|---|

| Deputy | Rostering, Time & Attendance, Award Interpretation | Automated Award calculations for shifts. | Xero, QuickBooks, MYOB |

| Tanda | Compliance and Automation | Automated Rostering and time clock linked directly to pay rules. | Xero, QuickBooks, MYOB |

| FoundU | Full HR/Payroll Suite | All-in-one platform from onboarding to pay and compliance. | Xero, QuickBooks, MYOB |

The Power of Integration

Using an integrated system resolves all major payroll pitfalls:

* Automated Award Interpretation: An employee clocks on/off using the system. The software (e.g., Deputy) knows the employee is Casual, Level 2, and working on a Sunday. It automatically applies the correct 175% casual Sunday penalty rate and calculates the gross wage.

* Instant Accounting Sync: The correct, compliant payroll entry (Wages, PAYG Withholding, Superannuation, Allowances) is automatically pushed as a journal entry into your accounting software (e.g., Xero). **** This eliminates the manual keying of data and the risk of duplication or transcription errors.

Clean payroll data flows directly to your accountant—automatically.

* Superannuation Security: The system automatically calculates Super on the correct OTE and facilitates direct payment via SuperStream, ensuring timely and compliant contributions, eliminating the risk of the costly Superannuation Guarantee Charge (SGC).

* Free for Small Cafes: Several robust systems offer free tiers for very small businesses. For example, some time and attendance or STP platforms offer free solutions for teams under 10 or 20 employees (like ClockOn’s free STP solution or other offerings for very small teams), removing the cost barrier to compliance.

Handling Tips Digitally

Modern payroll and POS integrations allow you to formalise tip distribution. EFTPOS tips can be flagged in the POS, transferred to a separate bank account, and the distributed portion can be recorded and tracked via your payroll system (usually as a separate allowance or payment) to ensure accurate tax treatment and reconciliation.

Don't Let Payroll Steal Your Tax Time

For a cafe owner in Australia, the time gained from automating payroll is not just about saving accountant fees; it’s about reducing the immense personal stress and compliance risk associated with manual systems. Tax time delays are almost always traceable back to an unverified, complex payroll mess.

Switching to an integrated payroll system is the single most powerful step you can take to make your hospitality business genuinely BAS-READY. You automate the complex, minimise errors, and provide your accountant with clean, verifiable data instantly.

Be genuinely BAS-READY before tax season begins.

Download the BAS-READY Prep Guide and get our Payroll Checklist to cut your accountant's time in half and ensure total compliance.