Why does my Accountant take Months to file my Tax Return? (The Aussie Hospitality Bottleneck)

Cafe owner dealing with tax paperwork

It’s a familiar, frustrating scene for Australian hospitality owners—be it a bustling café, a regional pub, or a boutique hotel. You’ve had a massive year, you’ve handed over a mountain of paperwork to your accountant, and then the waiting game begins. Weeks tick by, tax deadlines loom, and the same question echoes: Why is my accountant taking so long? Are they just slow?

It’s time to flip the script. The widely held myth that your Australian tax agent is inefficient is usually just that—a myth. For businesses in the high-volume, regulation-heavy hospitality sector, the true cause of delay isn't the accountant's speed, but a crucial element that the client controls: Data Quality versus Data Quantity.

The Data Dilemma: More Than Just Receipts

Unorganized hospitality receipts compared with clean digital accounting records for tax preparation

When you deliver a box stuffed with thousands of Point-of-Sale (POS) reports, unsorted supplier invoices, and a jumble of bank statements, you’ve provided a high quantity of data. But what your accountant needs to meet the strict standards of the Australian Taxation Office (ATO) is high quality data.

In hospitality, low-quality data creates unique compliance nightmares. It forces your accountant to spend weeks acting as a forensic bookkeeper just to reconcile transactions before they can even begin calculating your tax liability.

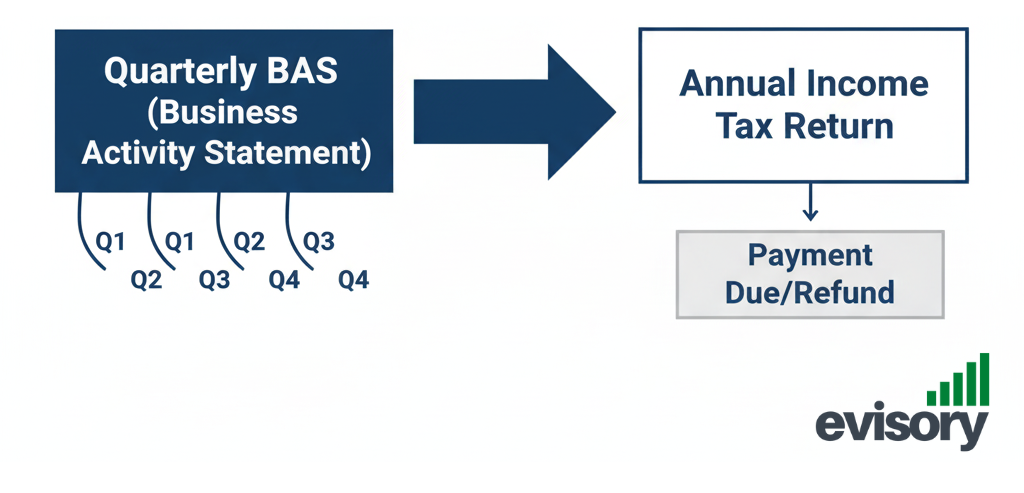

1. The GST Reconciliation Trap (The BAS Bridge)

Data Quality vs Data Quantity in Hospitality Accounting

For hospitality, the Business Activity Statement (BAS) is lodged monthly or quarterly, but the annual income tax return relies on these periodic figures being perfectly accurate.

• Low Quality: Your accountant receives an annual dump of bank statements and POS reports. The GST figures reported on the BAS must now be reconciled, line by line, against the annual figures. Missing invoices, incorrectly coded non-GST purchases (like basic food items), or a failure to separate taxable sales from GST-free sales (especially common with varied menu items) creates an immediate, massive audit trail.

• High Quality: You use integrated accounting software (like Xero or MYOB) where POS data automatically codes transactions, and the GST is tracked meticulously, allowing the accountant to easily verify the accuracy of the quarterly BAS lodgements against the final year-end accounts.

This meticulous reconciliation work—often involving dozens of queries back to the client about misplaced or miscoded transactions—is the single biggest cause of delay.

🏛️ Compliance is King: Protecting You from the ATO

Compliance checklist and financial documents representing ATO-ready hospitality tax reporting.

Your accountant's main job is not only to file your return but also to make sure you are 100% compliant with ATO regulations. The ATO sees the hospitality industry as high-risk due to its dependence on cash transactions, frequent staff changes, and complications around wages and allowances. As a result, your return faces more scrutiny.

The Compliance-Driven Timeline focuses on three important areas specific to Australian hospitality that cannot be rushed:

Complex Payroll and Superannuation (The Staff Challenge)

Hospitality payroll records showing staff wages, penalty rates, and superannuation tracking.

Managing casual staff, penalty rates, allowances, and the details of the Fair Work Act makes hospitality payroll notoriously complicated.

• Your accountant must verify that Superannuation Guarantee (SG) contributions have been correctly calculated and paid on time for all employees, including casuals. Mistakes here lead to massive penalties.

• They must also review allowances (e.g., meal or laundry allowances) to determine if they are deductible to the business and if they need to be included in the employee's assessable income. The source of delay? Missing or unclear employment contracts or payslips that don't clearly itemise these payments.

Inventory and Cost of Goods Sold (COGS) Accuracy

Restaurant inventory and stock records used to calculate accurate cost of goods sold.

Unlike a service business, your café or restaurant must accurately account for inventory.

• If you supply a simple stock-take spreadsheet without supporting documentation, your accountant has to verify the opening and closing stock valuations.

• Inaccurate COGS data, especially if supplier invoices are incomplete or categorized incorrectly, directly impacts your profit and GST credits. The ATO watches for inconsistencies here—a very low COGS compared to high turnover signals an immediate risk.

The Value-Added Stage: Review and Advising

Accountant reviewing financial reports with a hospitality business owner for tax planning.

Only when the compliance groundwork is perfect can your accountant take on a valuable advisory role. This role can save you money and justify their fee. It requires focused time rather than rushed data entry.

Your Australian tax agent’s final steps include a detailed review and advice on deductions relevant to your hospitality venue:

• Maximizing Deductions: They check your expenses to make sure you've claimed every valid hospitality-specific item, such as:

• Uniforms: You can deduct the purchase, repair, and cleaning costs of branded uniforms, chef's attire, and protective items like non-slip shoes and aprons.

• Renewals: You can claim the renewal cost of essential licenses, including the Responsible Service of Alcohol (RSA) or gaming licenses.

• Depreciation: They ensure you're correctly claiming depreciation on high-value assets like commercial ovens, coffee machines, and POS systems. They often apply temporary full expensing rules when possible.

• Structuring and Planning: They look beyond the current year to advise on structures (Pty Ltd, Trust, etc.), the correct use of the Simplified Trading Stock Rules, and strategies to minimise future tax liabilities.

When your accountant asks for "just one more document," it's likely not because they lost the previous 100 pages, but because that single document (e.g., a specific supplier invoice or a detailed log of business mileage) is the necessary missing link required to legally and compliantly finalise your figures and maximise your allowable deductions under ATO rules.

To get your return filed in weeks, not months, your best move is to transition from a quantity data provider to a quality data partner. Give your accountant clean, reconciled data, and they can devote their time to protecting you from an audit and finding you legitimate savings.

💡 Speed Up Your Australian Tax Return Today

Digital accounting tools and checklists used to streamline hospitality tax lodgement.

Your accountant is waiting for high-quality data. To accelerate your lodgement, focus on:

1. Digital Integration: Link your POS system directly to cloud accounting software (Xero, MYOB) and use integrated payroll (Single Touch Payroll) correctly.

2. Regular Reconciliation: Reconcile your bank accounts and check your GST coding monthly, not annually.

3. Clean Submissions: Provide a digital, itemised list of all expenses and income, supported by clear folders of invoices, instead of a physical box of receipts.

Your accountant’s diligence is your protection. When they take time, it’s because they are ensuring your business is 100% compliant with the ATO—and that’s worth the wait.

Find out the 3 critical documents that cause the most delays—download our guide.